So I thought I should post something relevant to my internship before I finish up this week…the two types of instruments which are dealt with on a most regular basis, are Interest-rate swaps and credit-default swaps:

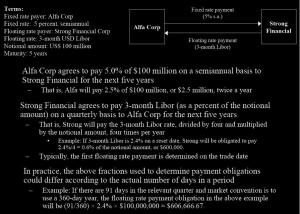

An interest rate swap is a contractual agreement to exchange a stream of periodic payments with a counterparty. The traditional interest rate swap agreement is an exchange of fixed interest payments for floating rate payments:

(Click to enlarge)

A Credit default swap (CDS) is a swap designed to transfer the credit exposure of the reference obligation between parties.

It is an agreement between a protection buyer and a protection seller whereby the buyer pays a periodic fee in return for a contingent payment by the seller upon a credit event (such as a certain default) happening in the reference entity

§ A pension fund owns USD 10 million worth of a 5 year bond issued by Risky Corporation;

§ In order to manage their risk of losing money if Risky Corporation defaults on its debt, the pension fund buys a CDS from Derivative Bank in a notional amount of 10 million dollars which trades at 200 basis points;

§ In return for this credit protection, the pension fund pays 2% of 10 million (200,000 euro) in quarterly installments of 50,000 euro to Derivative Bank;

§ If Risky Corporation does not default on its bond payments, the pension fund makes quarterly payments to Derivative Bank for 5 years and receives its 10 millions loan back after 5 years from the Risky Corporation;

§ Though the protection payments reduce investment returns for the pension fund, its risk of loss in a default scenario is eliminated;

§ If Risky Corporation defaults on its debt 3 years into the CDS contract then the premium payments would stop and Derivative Bank would ensure that the pension fund is refunded for its loss of USD 10 million